Before you leave...

Take 20% off your first order

20% off

Enter the code below at checkout to get 20% off your first order

Discover summer reading lists for all ages & interests!

Find Your Next Read

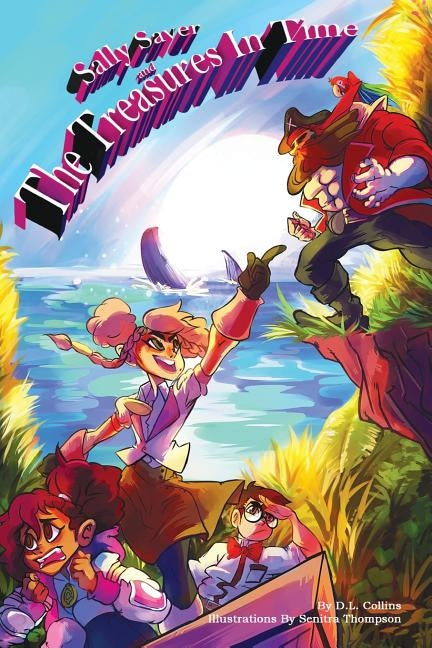

Sally Saver and her friends Casey Cash, Sam Spender, and Billy Budget are on a backyard adventure when they stumble upon a mysterious stone with magical time-traveling powers.The friends' adventure soon gets a blast from the past as they find themselves on the high seas with a crew of treacherous pirates.When they notice the pirates have stolen valuable treasure, Sally and her pals decide nab it and take it back to modern times where they'll use it for good. But when the friends return home, their differing personalities and attitudes toward money result in a clash of opinions.Should it be saved, spent in one spot, or invested? Rick Slickster has his own ideas for the treasure. So the friends will have to put their heads together to make the right decision before it's too late.Sally Saver and the Treasures in Time is an interactive adventure that allows young readers to decide where the story goes as they learn the basics of finance: saving, budgeting, and the consequences of financial decisions. With numerous paths to choose and six different endings, this educational tale will keep youngsters coming back long after it ends.

Demeitrice L. Collins holds a bachelor's degree in finance from Clayton State University. Collins owned and operated a financial lending business for twelve years, then went on to start the Literacy for Youth Foundation which strives to promote financial education and end hunger for children in southeast Georgia. In 1998, he pursued a career in mortgage finance, after which he started his own mortgage corporation. For many years, he had to decline good people for loans because their credit made them ineligible. When he inquired about how clients got into their particular situations, he noticed a trend as responses were usually similar. Clients mentioned that nobody taught them how to manage credit. Many explained how their parents could not teach them about saving money because they worked two jobs just to make ends meet and there wasn't enough left over to save. Many stated that their parents never explained how to balance a checkbook and that although schools taught them the meaning of the word 'budget' they failed to explain how to apply it to everyday life. Collins decided to help others who are in similar situations by creating a series of books that are not in a textbook format, making them more fun and enjoyable to learn from. His inspiration behind this project is to teach financial fundamentals.

Thanks for subscribing!

This email has been registered!

Take 20% off your first order

Enter the code below at checkout to get 20% off your first order